- Telecommunications Giant Vodafone Leaves the Libra Association

- Group of Central Banks Assesses Developing Central Bank Digital Currencies

- South Korea Might Impose 20 Percent Tax on Cryptocurrency Profits

- Report: Terrorists Increasingly Use Crypto to Raise Funds Anonymously

- Canadian Securities Administrators Subject Crypto Exchanges to Securities Laws

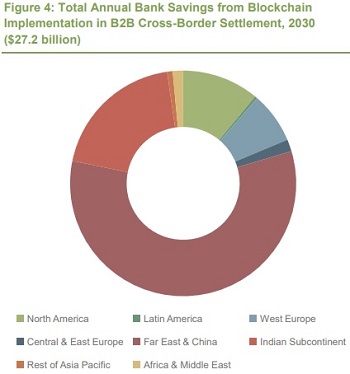

Research: By 2030, Blockchain Could Save Banks $27 Billion a Year

If you ever asked yourself why do major banks take a stance of “no crypto, yes blockchain” such as JPMorgan CEO’s, the answer can be found in a recent study from Juniper Research. Whilst cryptocurrencies themselves can shift wealth from traditional centralized currencies like the dollar to decentralized digital coins such as Bitcoin, the study reveals that blockchain can actually save banks a colossal amount of money.

The study, labeled “The Future of Blockchain: Key Vertical Opportunities & Deployment Strategies 2018-2030,” offers a deep dive into the blockchain pool with comprehensive analysis and projections into the next decade in a variety of fields. The most intriguing one is of course the financial services sector.

According to the study, an implementation of a blockchain-based system would enable banks to standardize their currently wasteful processing systems and significantly decrease the risk of error. Even more so, such a blockchain-based system will result in great savings that would come from compliance and credit history as blockchain allows complete traceability of financial documentation. The study’s model projects that in 2024 blockchain could save $1 billion a year for banks, and by 2030 it could reach to over $27 billion of savings a year!

Other sectors that could greatly benefit from blockchain technology are:

Land Registry: By using a blockchain solution, land registries can both reduce the need to retain physical archives and create greater, faster visibility. Also, according to the World Bank, only 30% of land rights are registered or recorded worldwide.

Food Provenance: Utilizing blockchain to record the provenance of food would remove any opportunity to tamper with records, thereby both providing reassurance to the consumer and reducing the risk of bacterial infection (which might arise from consuming out of date meat).

Automotive: Blockchain can be used to focus on areas such as asset tracking on an open registry, thereby validating and authenticating vehicle ownership. A further use case might lie in supply chain finance, removing the dependence on time-consuming, paper-based processing and reducing the settlement period between a manufacturer delivering vehicles to distributors or dealers and receiving payment for those vehicles.

Healthcare: A blockchain-supported system that was already announced in the U.K. will focus heavily on patient adherence to a personalized treatment plan, continuous monitoring and verification, critical to positive health outcomes. It has been argued that implementing this kind of system will enable significant savings for health services. For example, estimates of the economic impact of non-adherence range from $100-290 billion per annum in the U.S.

Digital favorites

- Siti Di Scommesse

- Casino Bonus Senza Deposito Immediato

- Best Casinos Not On Gamstop

- Casinos Not On Gamstop

- UK Casinos Not On Gamstop

- Non Gamstop Casinos

- UK Casinos Not On Gamstop

- Casino Not On Gamstop

- Non Gamstop Casino

- Slots Not On Gamstop

- Meilleur Casino En Ligne France

- Gambling Sites Not On Gamstop

- オンライン カジノ おすすめ

- Gambling Sites Not On Gamstop

- Non Gamstop UK Casinos

- UK Casino Sites Not On Gamstop

- UK Casinos Not On Gamstop

- Non Gamstop Casinos UK

- Non Gamstop Casino Sites UK

- Best Slot Sites

- UK Online Casinos Not On Gamstop

- Best Non Gamstop Casino

- Best Sports Betting Sites Not On Gamstop

- Meilleur Casino En Ligne

- Migliori Casino Online

- Meilleur Site De Casino En Ligne

- Pari Sportif Belgique

- Siti Casino

- Meilleur Site De Paris Sportif International

- 익명 카지노

- Fm 카지노

- Casino Sans Verification

- Real Money Casino App No Deposit

- Siti Non Aams Bonus Senza Deposito

- Casino Non Aams

- Meilleur Casino En Ligne Belgique

- Site De Poker

- Casino En Ligne 2026

- Meilleur Casino En Ligne 2026

- Casino Online Non AAMS